Over the past decade, Bitcoin and other digital assets have transformed from niche experiments into globally traded financial instruments.

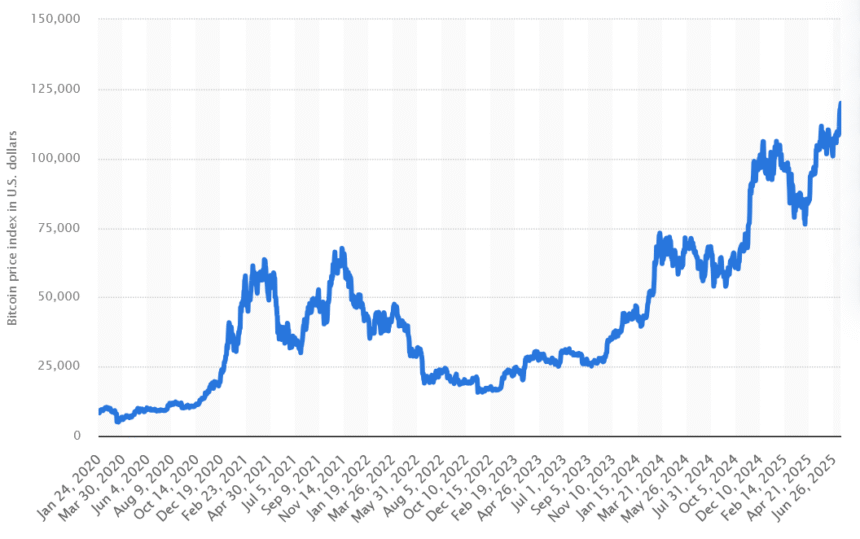

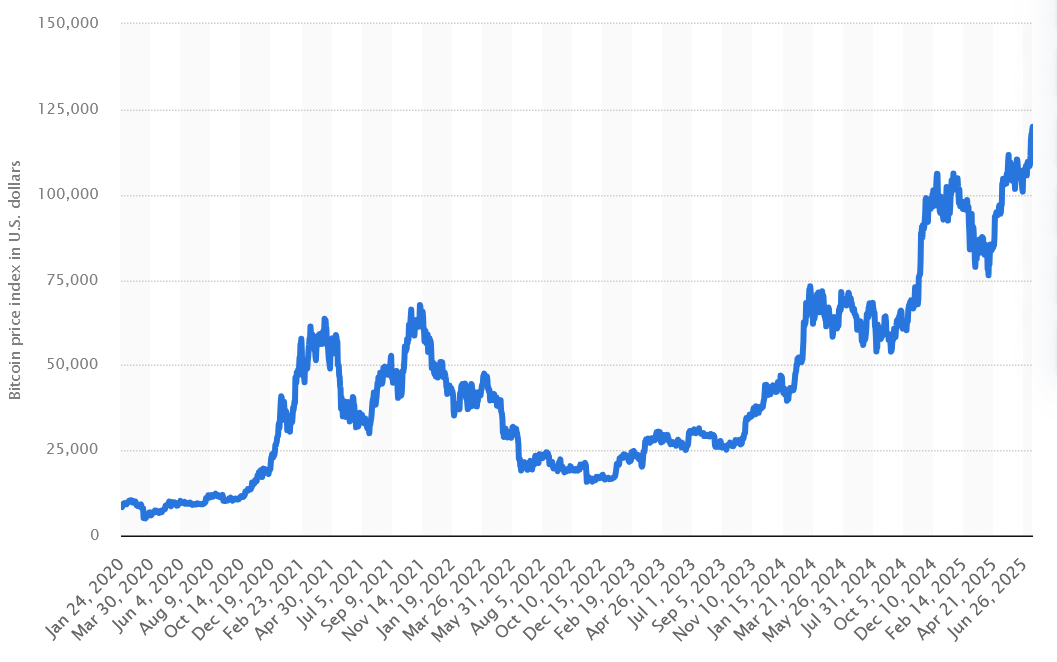

According to Statista, Bitcoin reached an all-time high of over $68,000 in 2021, and the total market capitalization of cryptocurrencies exceeded $1 trillion in 2024. Every day, billions of dollars flow through major crypto exchanges, creating a fast-paced environment full of both risks and opportunities.

Bitcoin (BTC) price per day from January 24, 2020, to July 15, 2025

One of the most efficient and low-risk ways to profit from these market dynamics is through crypto arbitrage trading, which involves purchasing an asset at a cheaper price on one exchange and selling it at a higher price on another.

This method is known as cross-exchange arbitrage, and it has become increasingly automated thanks to the rise of arbitrage trading bots.

In this article, we’ll explore how these bots work, which trading strategies they rely on — from spatial arbitrage to triangular arbitrage — and how you can go from idea to launch with a custom-built arbitrage bot development process.

What Is Crypto Arbitrage and Why Does It Matter?

Crypto arbitrage is a trading technique that involves profiting from price discrepancies between the same cryptocurrency on multiple trading platforms and exchanges. Unlike long-term investments or speculative trading, arbitrage traders rely on precise mathematical calculations and aim to minimize risk by quickly buying and selling assets.

On cryptocurrency exchanges, prices are formed independently, based on supply, demand, and trading volume on each specific platform. A simple example: a trader notices that on one exchange, Ethereum is priced at $1,800, while on another it’s $1,850.

They acquire the asset at a reduced price and instantly resell it at a higher price, thereby securing a profit. In a high-speed, automated environment, this can happen within seconds, especially when a crypto arbitrage trading bot is involved. Even a $50 difference represents a real arbitrage opportunity, especially when the trade is scaled up.

Major Types of Crypto Arbitrage

Crypto arbitrage isn’t just a single tactic — it’s a whole set of strategies that traders use depending on market conditions and personal goals. Some are simple and great for beginners, while others are more complex but potentially more profitable.

Let’s break down the main types of arbitrage and see why cross-exchange arbitrage has become one of the most popular approaches today.

1. Simple Arbitrage on One Exchange

This is the most straightforward method. Everything happens within a single crypto exchange. For example, you might notice a price difference between ETH/USDT and BTC/ETH trading pairs, and make a quick series of trades to capture a profit.

There’s no need to move funds between exchanges, so it’s faster and safer. That said, opportunities are limited and require precise timing and calculation to make it worthwhile.

2. Cross-Exchange Arbitrage — One of the Most Effective Strategies

This is a go-to strategy for both solo traders and institutional players. The idea is simple: buy a cryptocurrency where it’s cheaper and simultaneously sell it on another platform where it’s priced higher.

It becomes even more powerful when executed across multiple exchanges, especially when paired with automation. That’s where cross-exchange arbitrage bots come in — they track prices in real time and instantly execute trades, without any manual effort on your part.

3. Triangular Arbitrage — Advanced but Rewarding

Looking for something more sophisticated? Triangular arbitrage might be the type you need. This strategy happens within one cryptocurrency exchange and involves trading between three currencies to exploit price mismatches.

For example, you might go from BTC to ETH, then ETH to USDT, and finally USDT back to BTC — ideally ending with more BTC than you started with. It sounds simple, but the execution requires speed and accuracy, which is why it’s often handled by a crypto trading bot.

How Arbitrage Bots Work: Step-by-Step

Arbitrage bots profit from price differences between marketplaces or exchanges for the same asset. Here’s how they function:

1. Price Monitoring

The bot continuously scans multiple exchanges (e.g., Binance, Coinbase, Kraken) for the same cryptocurrency (e.g., BTC, ETH). It tracks order books, trade history, and liquidity to identify price discrepancies.

2. Profit Calculation

The bot calculates potential profit after accounting for:

- Price spread (the disparity between the purchase and sale prices).

- Transaction fees (trading, withdrawal, deposit fees).

- Network fees (also known as gas fees for blockchain transactions).

- Slippage (price changes during execution).

If the net profit exceeds a predefined threshold, the bot proceeds.

3. Automatic Trade Execution

The bot buys the asset at the lower price on Exchange A. Simultaneously (or near-instantly), it sells at the higher price on Exchange B. Profits are realized in stablecoins or another preferred currency.

Types of Crypto Arbitrage Bots

Arbitrage bots automate the search for price differences in the crypto market, allowing traders to profit from market inefficiencies. In this block, we’ll break down the 4 main types of such bots. You will learn how each of them works, where they are used, and what features to consider when using them.

1. Spot Arbitrage Bots

Spot arbitrage bots look for price differences in the spot market (instant trades). Example: buying BTC on Binance at $30K and selling on Kraken at $30.1K. Overall, it’s fast, but it depends on liquidity and fees. Suitable for beginners as they don’t require working with derivatives.

2. Cross-Exchange Arbitrage Bots

These bots utilize price discrepancies between different exchanges (e.g., BTC is cheaper on Bybit than on OKX). Here, trading requires fast transfers and accounting for withdrawal fees, while effectiveness depends on the speed of fund transfers between platforms.

3. High-Frequency Trading (HFT) Bots

HFT bots operate on microscopic price differences, executing hundreds of trades per second. They normally require powerful servers and direct connection to exchanges and are primarily available to professional traders and institutional players.

4. Hybrid Arbitrage Solutions

Hybrid bots combine multiple strategies: spot, futures, triangular arbitrage (e.g., BTC → ETH → USDT → BTC). Generally, they are complex but flexible and allow maximizing profits by simultaneously utilizing different arbitrage opportunities.

How to Create a Crypto Arbitrage Bot from Scratch

It is crucial to admit that the effective deployment of such a bot requires both technical expertise and in-depth knowledge of the cryptocurrency market. Below, we will discuss in detail the key stages of developing a crypto arbitrage bot.

1. Choosing the Technological Solution

There are several ways to create an arbitrage bot for a business. You can use ready-made SaaS platforms that offer basic functionality without the need for development. However, these solutions are often limited in customization options.

A more promising option is to request custom development. This will require a higher investment, but will give you a competitive advantage through unique trading algorithms.

2. Organizing Market Data

The effectiveness of an arbitrage bot directly depends on the quality of the data it receives. Crypto bots connect directly to the APIs of major exchanges, obtaining real-time information about prices and volumes. Special attention is given to data transfer speed — even a millisecond delay can turn a trade unprofitable.

Modern systems use WebSocket technologies for instant price updates. This takes into account all commissions and hidden costs, which allows you to accurately calculate your profit.

3. Arbitrage Opportunity Search Algorithm

The heart of any arbitrage bot is its analytical module. It continuously compares prices for identical assets across different exchanges, identifying even the smallest discrepancies.

Modern algorithms take into account not only current prices but also the order book depth, liquidity, and historical volatility. Before executing a trade, the system calculates the net profit after all fees and determines the optimal trade volume.

It is important to understand that most identified opportunities last only fractions of a second, so decision-making speed is critical.

4. Trade Execution Mechanism

Once a profitable opportunity is identified, the bot immediately moves to execute the trade. At this stage, system reliability is key. Good bots have built-in risk control mechanisms — position size limits, stop-losses, and protection against technical failures.

Special attention is paid to managing balances — the system must quickly redistribute funds between exchanges, maintaining the optimal asset ratio.

Practice shows that even a small advantage in execution speed (10-50 ms) can lead to up to 30% additional profit in the long run.

5. Strategy Testing and Optimization

Before going live, any strategy undergoes thorough testing. Historical backtesting allows you to check the algorithm’s performance on past data. Next comes the paper trading phase, where the system operates with virtual funds in real market conditions.

Only after confirming stable profitability can trading volumes be gradually increased. It is important to understand that the market is constantly changing, so even successful strategies require regular adjustments and parameter optimization.

6. Operation and Scaling

Once the system is live, it requires constant monitoring. Qualified developers analyze performance, adjust parameters, and expand the list of connected exchanges.

Modern solutions provide detailed analytics for all trades, which allows for precise profitability evaluation. As volumes grow, it’s worth considering switching to dedicated servers located near exchange data centers — this can provide an additional speed advantage.

Challenges In Cross-Exchange Arbitrage Bot Development

Developing an arbitrage bot requires consideration of many technical and organizational aspects. The table below outlines the key features and challenges faced by developers and users of such systems.

| Aspect | Challenges |

| The need for precise synchronization of prices between different exchanges. High execution speed to take advantage of arbitrage opportunities. | High requirements for connection speed, network delays, and differences in APIs between exchanges. |

| Protection of API keys from unauthorized access and misuse. | Vulnerabilities in storing and transmitting keys, the need for regular changes, and the use of security methods such as two-factor authentication. |

| Proper handling of API errors, trade cancellations, and minimizing slippage during trade execution. | Difficulties in correctly handling real-time errors and the impact of slippage on trade efficiency. |

| Comparing available open-source solutions and developing a custom solution based on requirements. | Evaluating the security, flexibility, and performance of open-source solutions, as well as the cost of custom development. |

| Ensuring sufficient liquidity on both exchanges for executing arbitrage trades. | Risks related to insufficient liquidity, changes in liquidity at the time of trade execution. |

| Continuous monitoring of the bot, market, and exchanges’ conditions. Setting up alerts for potential failures or profitable arbitrage opportunities. | Setting up effective monitoring and alert systems, minimizing false triggers, and avoiding missing important events. |

| Compliance with legal and regulatory requirements when conducting trades on different exchanges. | Legal restrictions on the use of bots and difficulties in determining the legality of operations on international markets. |

| Risk assessment and minimization related to arbitrage trades, including the possibility of sudden changes in crypto market conditions. | Exposure to high risks in case of market instability or errors in calculations. |

| Development of a user-friendly interface for monitoring and managing the arbitrage bot. | Difficulties in creating an intuitive interface that is useful both for beginners and experienced traders. |

Challenges In Cross-Exchange Arbitrage Bot Development

Why Choose SCAND for Cross-Exchange Arbitrage Bot Development

Our team specializes in developing powerful, unique solutions for crypto arbitrage. With years of experience in fintech, we create intelligent trading systems that guarantee stable profits.

We offer a personalized approach, which includes the analysis of your business objectives and the delivery of the end product. Our bots provide lightning-fast trade execution, precise arbitrage opportunity calculation, and reliable protection of your assets.

To help clients accelerate development, we also offer a ready-made Bot Starter Kit — a customizable foundation for making efficient crypto trading bots. It significantly reduces time to market and allows you to focus on strategy and performance optimization from the start.

SCAND doesn’t just develop software — we create fully functional trading tools with adaptive algorithms that continue to perform effectively, even in highly volatile market conditions. We support the project at every stage, from strategy testing to post-sale support and system scaling.

By choosing SCAND, you gain a competitive edge: a technological solution developed by professionals who understand both the technical and financial aspects of crypto arbitrage.